The Federal Reserve Board on Thursday released its hypothetical scenarios for a second round of lender strain tests. Before this 12 months, the Board’s initially round of strain tests discovered that substantial banks had been properly capitalized underneath a assortment of hypothetical gatherings. An more round of strain tests is staying executed thanks to the ongoing uncertainty from the COVID celebration.

Significant banks will be analyzed in opposition to two scenarios showcasing significant recessions to assess their resiliency underneath a assortment of outcomes. The Board will launch business-certain outcomes from banks’ efficiency underneath both of those scenarios by the close of this 12 months.

The Board’s strain tests support make sure that substantial banks are equipped to lend to homes and companies even in a significant economic downturn. The exercise evaluates the resilience of substantial banks by estimating their mortgage losses and money levels—which offer a cushion in opposition to losses—under hypothetical economic downturn scenarios above 9 quarters into the long run.

“The Fed’s strain tests before this 12 months showed the power of substantial banks underneath numerous different scenarios,” Vice Chair Randal K. Quarles claimed. “Despite the fact that the overall economy has enhanced materially above the very last quarter, uncertainty above the course of the subsequent few quarters continues to be unusually superior, and these two more tests will offer a lot more info on the resiliency of substantial banks.”

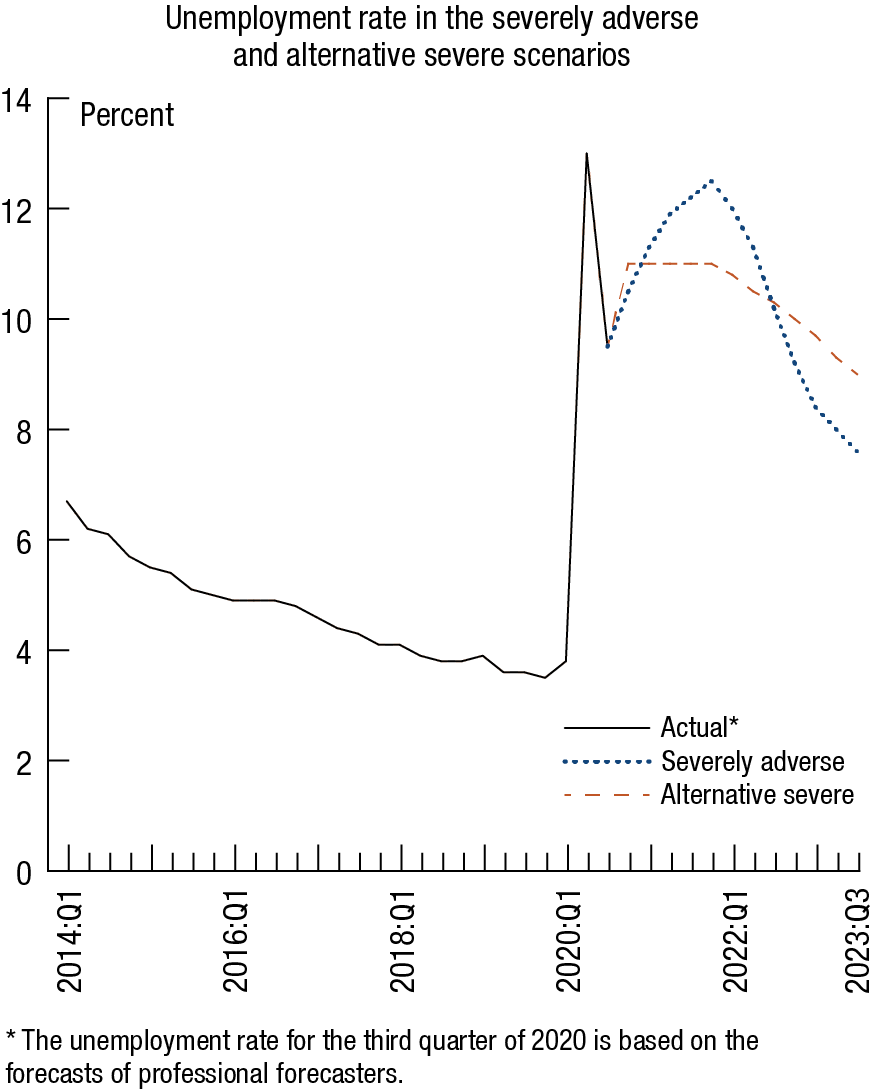

The two hypothetical recessions in the scenarios function significant global downturns with significant strain in financial markets. The initially scenario—the “seriously adverse”—features the unemployment rate peaking at 12.5 % at the close of 2021 and then declining to about seven.5 % by the close of the situation. Gross domestic product declines about 3 % from the 3rd quarter of 2020 by the fourth quarter of 2021. The situation also characteristics a sharp slowdown overseas.

The second scenario—the “alternate significant”—features an unemployment rate that peaks at 11 % by the close of 2020 but stays elevated and only declines to nine % by the close of the situation. Gross domestic product declines about 2.5 % from the 3rd to the fourth quarter of 2020. The chart down below reveals the route of the unemployment rate for each situation.

The two scenarios also incorporate a global marketplace shock ingredient that will be utilized to banks with substantial buying and selling operations. Those banks, as properly as sure banks with significant processing operations, will also be demanded to incorporate the default of their premier counterparty. A desk down below reveals the factors that utilize to each business.

The scenarios are not forecasts and are considerably a lot more significant than most present baseline projections for the route of the U.S. overall economy underneath the strain screening time period. They are built to assess the power of substantial banks through hypothetical recessions, which is specifically proper in a time period of uncertainty. Just about every situation involves 28 variables covering domestic and intercontinental financial activity.

In June, the Board released the outcomes of its once-a-year strain tests and more analyses, which discovered that all substantial banks had been adequately capitalized. However, in mild of the heightened financial uncertainty, the Board demanded banks to acquire various actions to maintain their money stages in the 3rd quarter of this 12 months. The Board will announce by the close of September no matter if these actions to maintain money will be prolonged into the fourth quarter.

| Lender | Issue to global marketplace shock | Issue to counterparty default |

|---|---|---|

| Ally Financial Inc. | ||

| American Express Corporation | ||

| Lender of America Company | X | X |

| The Lender of New York Mellon Company | X | |

| Barclays US LLC | X | X |

| BMO Financial Corp. | ||

| BNP Paribas Usa, Inc. | ||

| Cash A single Financial Company | ||

| Citigroup Inc. | X | X |

| Citizens Financial Team, Inc. | ||

| Credit Suisse Holdings (Usa), Inc. | X | X |

| DB Usa Company | X | X |

| Find out Financial Products and services | ||

| DWS Usa Company | ||

| Fifth Third Bancorp | ||

| The Goldman Sachs Team, Inc. | X | X |

| HSBC North America Holdings Inc. | X | X |

| Huntington Bancshares Integrated | ||

| JPMorgan Chase & Co. | X | X |

| KeyCorp | ||

| M&T Lender Company | ||

| Morgan Stanley | X | X |

| MUFG Americas Holdings Company | ||

| Northern Belief Company | ||

| The PNC Financial Products and services Team, Inc. | ||

| RBC US Team Holdings LLC | ||

| Locations Financial Company | ||

| Santander Holdings Usa, Inc. | ||

| Point out Road Company | X | |

| TD Team US Holdings LLC | ||

| Truist Financial Company | ||

| UBS Americas Holding LLC | X | X |

| U.S. Bancorp | ||

| Wells Fargo & Corporation | X | X |

For media inquiries, connect with 202-452-2955

More Stories

Some Straight Talk on Affiliate Marketing

The Best Email Internet Marketing Strategy

Building Champions on and Off the Dance Floor: Kids GI BJJ and Adult Dance Lessons